Our Mission

The BMCAA is committed to empowering British businesses by providing information and access to capital through the Merchant Cash Advance product — helping to drive growth and strengthen the UK economy.

A Merchant Cash Advance is classed as an alternative business finance product in the UK. An MCA, otherwise known as a Business Cash Advance, provides businesses with an advance of funding in return for a percentage of future credit and debit card income. This is taken directly from the processor until the funding has been repaid.

The alternative finance sector is supported by the British Business Bank and FSB in a bid to help UK business owners find the funding they need to grow.

Since the 1st of November 2016, the main UK banks have been obliged to refer customers who didn’t qualify for a business loan with them to alternative forms of business funding products. One of these products is a merchant cash advance which is a viable choice for businesses who process card payments with their customers.

Many businesses are using the product as awareness grows. The BMCAA acts as a website where you can find out more information on the lenders and their respective merchant cash advance product(s).

A Guide to Merchant Cash Advances

Learn all about MCAs and how they work in our online guide.

Read Guide

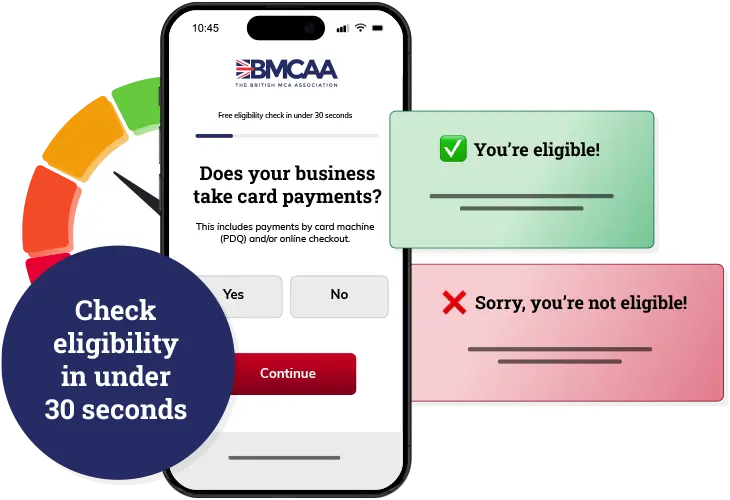

Check if you qualify for a Merchant Cash Advance in seconds

Compare free quotes from lenders and discover other funding options available to your business in just a few clicks.

Check Eligibility

The Providers

Search Direct Lenders and Brokers in the UK

View a list of merchant cash advance companies, or click on the logos above.

Search Directory Check Eligibility